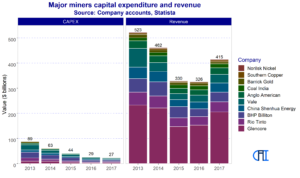

Capital expenditure of the 10 largest mining companies faded 69.7% between 2013 and 2017, whereas revenue only fell 37.7% at its lowest, and was down just 20.7% in 2017.

This hints at a shift in the focus of the supply-base towards near-term profitability. This makes sense. With today’s high cost of investing in assets and the concentration of world-class mining assets in the hands of a limited number of companies, investment is neither good for margins nor needed to maintain market share.

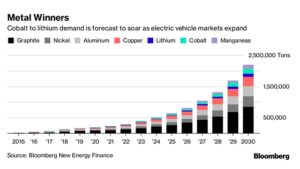

In 2016 and 2017, lithium and cobalt prices ramped up on supply tightness, as demand from electric vehicles (EVs) rose. Only when prices had already rocketed, did miners, with lithium and cobalt mines, make investments in those “hot” commodities. However, with a lead-time of years, prices will stay high for an extended period. This is good for miners looking to please shareholders, but could spell trouble in the coming years, as high prices may strangle demand.

Take graphite. Like lithium and cobalt, graphite is a key input in EV batteries, and so demand is expected to rise rapidly in the coming years. Graphite can be “natural”, from mined sources, or “synthetic”, where it is manufactured from coke or another hydrocarbon. Presently, natural graphite satisfies two-thirds of EV demand, with synthetic one-third.

Recently I produced a forecast of the supply-demand balance for natural graphite. The concern for the supply-base is not the incredible potential of demand in the coming 5-10 years, but limiting the oversupply today. Simplifying the situation, oversupply means downward price pressure, which brings low or negative margins.

My argument was that without investment today supply would tighten and prices rise. While good for margins today, higher prices could push purchasers towards synthetic graphite, which has fewer supply issues. When natural graphite supply rises and prices fall, recovery of the loss market share is unlikely, as battery manufacturers would not want the additional cost of retooling.

Today, low or negative profits may be a contraindicator to investing in natural graphite mines, or other niche minerals mines. However, in the medium- and long-terms investment is necessary to ensure a sector doesn’t lose out to a competing product or so increase the cost of a new product, that it doesn’t achieve its potential. Selling low profitability to share-holders is a hard task, but explaining why demand has collapsed because of a focus on short-term profit will be harder.