Agricultural products show that despite strong production-cycles price volatility can be small

With agricultural products, the obvious take-away is the clear lack of changes to prices across the year. Prices might be expected to change across the year, as output has a strong annual production cycle. However, price changes between months is subdued and often absent.

Before looking at wheat, one of the most traded commodities, it is worth

remembering where hedging first arose: In agricultural products. So clear was the mutual need for both producers (farmers, fishermen, shepherds, …) and buyers to smooth the flow of produces and prices that they developed the necessary tools and logistics to limit seaonsal effects.

So, while the production cycle of wheat, coffee, or most agricultural commodities should bring supply-forced seasonality, the use of these tools limits the volatility.

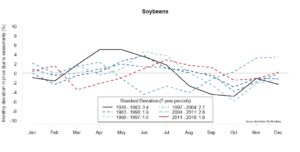

This is the graph of seasonality in soybeans.

In the chart of soybeans, two things are clear; firstly, seasonality is very low – accounting for no more than a few percent of the underlying price, and secondly, seasonality has changed little over the last 50 years. Despite the increased financialisation of commodities, changes in production techniques and the growth of Chinese demand, there has been next-to-no change in the degree of seasonality. The conclusion is that stabilisation tools and logistics, such as warehousing, are being used and used effectively.

In the chart of soybeans, two things are clear; firstly, seasonality is very low – accounting for no more than a few percent of the underlying price, and secondly, seasonality has changed little over the last 50 years. Despite the increased financialisation of commodities, changes in production techniques and the growth of Chinese demand, there has been next-to-no change in the degree of seasonality. The conclusion is that stabilisation tools and logistics, such as warehousing, are being used and used effectively.

In some commodities these tools are through price controls, and other financial instruments. Some agricultural products have strong collectives that help to smooth production and price. However, as seen recently in oil, an overseeing institute – such as OPEC – is not sufficient to control prices in the face of oversupply, financial trading and technological changes.

Similar conclusions can be made for most agricultural commodities that the World Bank carries in “The Pink Book”.

Using another source, the US Agricultural Service, a similar conclusion shows that this lack of volatility goes back to the turn of the last century. US hard red winter (HRW) wheat prices have fallen substantially on a real basis since the first years of the 20th century, but the seasonality has been mostly unchanging, except for one period.

Using another source, the US Agricultural Service, a similar conclusion shows that this lack of volatility goes back to the turn of the last century. US hard red winter (HRW) wheat prices have fallen substantially on a real basis since the first years of the 20th century, but the seasonality has been mostly unchanging, except for one period.

For interest, the high volatility in the 1970-1982 period was specific to the United States. The US producers had difficulty adapting to the new international wheat agreement that coincided with a period of bountiful harvests. After revisions to the agreements and a tightening of the supply-demand balance, US farmers could once again participate in the international market and take longer-term and less volatile contracts.

In these investigations of seasonality, it is apparent that commodity classes are adapting differently to the impact of seasonality. Some industrial products, such as base metals, have well established financialisation, which brings less volatility in the prices. In comparison, energy is seeing volatility increase due to the changes both in the supply and demand. When these developments are more ‘business as usual’, the hedging tools will come into play to reduce the flow, but until then petrol/”gas” prices will continue to cycle.

For well established products, where both sellers and buyers benefit from stability, there are tools to achieve low fluctuations through the year. With many decades, agricultural products show that most price-seasonality can be removed, even when production is seasonal.